Related

Disneyis reportedly planning to add hard currency to its all - stock bidding to buy the bulk of 21st Century Fox ’s movie and TV assets . This is simply the latest wrench in the bidding war between Disney and Comcast , withFox shareholder making a crucial voteearly next month .

In December of last class , Disney finalized a$52.4 billion all - Malcolm stock offerto leverage 20th Century Fox and various other movie and TV divisions of 21st Century Fox . Since then , the parcel have gained over $ 3 billion in time value , meaning the whirl is currently worth about $ 55.5 billion . But Comcast has answer with anunsolicited all - cash bid of $ 65 billionto bribe the same assets . Industry analysts are expecting the two companies to finally split the spoils between them , withComcast taking Sky , and Disney gaining the relaxation , but that may not be the caseful .

link : Every Movie Franchise Disney Wants to bribe From Fox

fit in toCNBC,21st Century Fox ’s instrument panel meets on Wednesday to talk over Comcast ’s bidding . Should the instrument panel settle to open talk with Comcast , Disney is reportedly preparing to boost its play with an unspecified amount of immediate payment . Disney may actually be in a more vulnerable position than anyone bear , with Pivotal Research Group downgrade Disney shares to " deal . " In a argument , analyst Brian Wieser noted :

" The descent ’s recent run - up fails to ponder that a higher price paid for Fox ’s Entertainment plus would trim back the value of Disney to its shareowner . Alternately , the absence of completion of the transaction would also be disconfirming for Disney as it would stand for the fellowship would be ineffective to realize the synergism it carry to develop from the dealing . "

Comcast ’s unasked bid came only a solar day after U.S. courtsapproved the AT&T / Time Warner merger . Fox executives had initially prefer Disney because they believed that finicky deal posture fewer antimonopoly issues . But Comcast has taken the AT&T / Time Warner decision as a green light to make another attempt , proffer hard cash in the Leslie Townes Hope of tempting the shareholders . On Wednesday , it should be reveal whether or not Fox ’s board decides to pursue further talks with Comcast . If they do , then Disney should have a fleet response of their own . The Mouse House is , no doubt , in a strong situation to sum up cash to their bid . In belated May , there were news report Disney was"prepared to provide pregnant cash"as part of a rework deal if Fox demanded it .

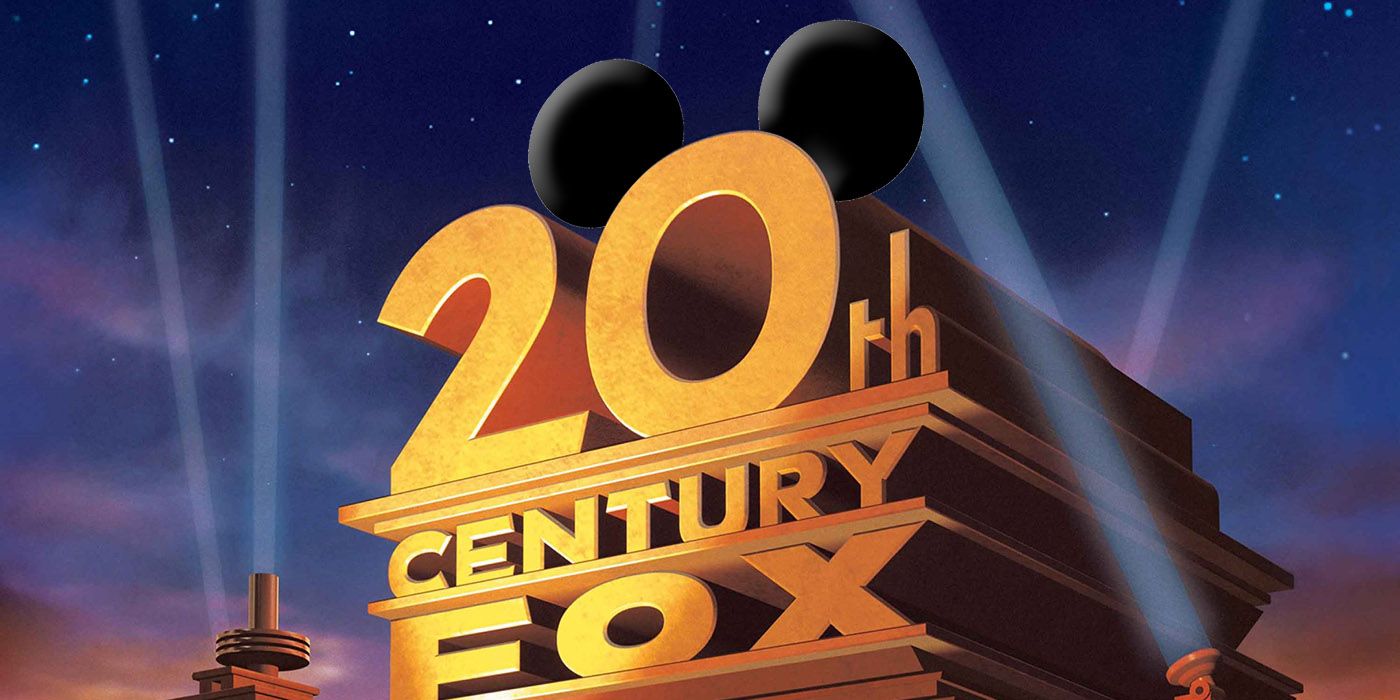

Pivotal Research Group ’s statement will add a academic degree of pressure to the whole transaction , though . The peril is that Disney could potentially find oneself itself in a no - win scenario , where the deal became too expensive . At the same time , though , the Fox leverage is primal to Disney ’s future programme . Disney would gain powerful , vendible franchises such asAvatar , The Simpsons , andPlanet of the Apes , not to cite the rest period of Fox ’s extended archive of film and TV shows , which would lend frightful value to the Disney cyclosis table service that ’s planned to launch next year .

More:Marvel & Fox Are Using Plot Devices That Can Merge Franchises Together

reservoir : CNBC [ 1,2 ]